Brexit - Filing your form VAT 100 Value Added Tax Return

Or call us

☎ 020 8810 4500 ![]()

I look forward to hearing from you

Vic Woodhouse

Ealing

London

W5 2PJ

VAT impact on trade with EU

UK Purchases/Imports from all countries including EU

- Postponed VAT accounting - similar to reverse charge

- UK VAT traders claim this treatment at the point of importation:

- Customs Handling of Import and Export Freight CHIEF system.

- Customs Declaration Service.

- Agent acting on your behalf.

- Include the amounts for goods landed in your quarterly VAT return period.

- Box 1 VAT due on imports + Payable

- Box 4 VAT reclaimed - Reclaim

- Box 7 Value of goods purchased excluding VAT Statistical

- Reverse charge - the HM Revenue & Customs logic:

- VAT payable appears in Box 1 + Payable.

- VAT reclaimable appears in Box 4 - Reclaim; often the same figure.

- HM Revenue & Customs are able, where necessary, to challenge and disallow any amount wrongly claimed in Box 4.

VAT can be really difficult and each trader needs to become an expert in his or her own trade. I hope that we can help you through the changes.

Retail UK Purchase/Import from abroad including EU

- For individual consignments with an intrinsic value’ under £135 - generally for online marketplace OMP

- The overseas seller charges the UK customer UK VAT and

- Accounts for the VAT to H M Revenue & Customs,

- After registering for VAT, often as a Non-established taxable person NETP.

- There is no allowed minimum trade level for a Non-established taxable person NETP. If you sell in the UK, from abroad, you must register for VAT.

- Intrinsic value excludes:

- Any separately identified charges, typically overseas: transport, insurance and other taxes.

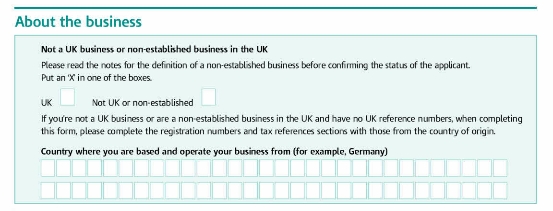

VAT registration - Non-established taxable person NETP

- what you need to know

Read more

about VAT registration - Non-established taxable person NETP.

Business-to-business UK Purchase/import from abroad including EU

- For individual consignments with an ‘intrinsic value’ under £135

- where the UK customer:

- Is VAT registered

- and is purchasing for their business

- and gives the overseas seller their VAT number

- which then appears on importation documents

- no VAT is payable at the point of importation.

- The customer accounts by reverse charge in Box 1 + Payable and Box 4 - Reclaim on their quarterly VAT return.

- Not applicable to goods involving duty, typically alcohol and tobacco.

- Low value consignment relief (LVCR) for goods valued at £15 or less is no longer available.

Retail sales - UK Sales/Exports to EU countries

- The customer can pay the local EU VAT on import but this will mostly be unpopular.

- The trader can register for VAT in the country to which they export; also unpopular.

- Up to 30th June 2021

- Individual consignments with an ‘intrinsic value’ under €22 are exempt from VAT and duty under existing low-value consignment relief

- Higher values before and after 1st July 2021

- Appoint a freight agent to take responsibility for EU VAT

- Use a marketplace facilitator (such as Amazon) deals with EU VAT

- From 1 July 2021

- Import One Stop Shop

- Individual consignments with an ‘intrinsic value’ under €150

- Register in one EU member state; possibly the Republic of Ireland.

- Charge VAT

- Complete a quarterly VAT return and pay VAT in that EU member state.

- UK Mini One Stop Shop MOSS, if you were supplying to EU digitally, no longer applies.

Business-to-business UK Sales/Exports to EU countries when the customer is VAT registered in their own country

There were pre-existing EU Directives which are helpful to Business-to-business UK Sales/Exports to EU countries.

A majority of EU countries allow Postponed VAT accounting

Meaning that the customer does not need to pay VAT on importation but uses their country’s equivalent of Postponed VAT accounting.

The two-Box + Payable - Reclaim system.

NOT Germany, Ireland, Italy and Slovakia.

A majority of EU countries allow Optional Reverse charge for VAT registered customers

Meaning that their VAT number needs to feature in importation documents.

VAT is recorded using the two Box + Payable - Reclaim system.

NOT Germany, Greece, Hungary, Ireland, Latvia, Lithuania, Luxembourg and Slovenia.

Supplying services to EU is now the same as any non EU country

outside the scope of VAT

Generally, services supplied from the UK to overseas customers:

do charge VAT to retail customers

do not charge VAT to business customers.

Read more

about Service place of supply - Place of belonging

inside and outside EU

The 27 EU Members list and VAT rates

Read more

VAT 27 EU member list and VAT rates

Current VAT return boxes (VAT100) are:

| VAT Box | VAT Return description | Our notes | £ |

|---|---|---|---|

| (Box 1): | VAT due in this period on sales and other outputs From 01/01/2021: VAT payable on imports under postponed VAT accounting Postponed VAT accounting is an option, available to VAT registered traders, which is made at the HM Customs point of importation. |

+ Payable | £ |

| (Box 2): | Northern Ireland only: VAT due in this period on acquisitions from other EC Member States After 01/01/2021 only applicable to acquisition of goods into Northern Ireland from EU. Our note: This is an in and out pay/reclaim transaction but the reclaim could be disallowed |

+ Payable include "-" in (Box 4): |

£ |

| (Box 3): | Total VAT due (the sum of boxes 1 and 2) | = | £ |

| (Box 4): | VAT reclaimed in this period on purchases and other inputs, Including applicable VAT payable on imports under postponed VAT accounting shown in Box 1. Northern Ireland only:(including acquisitions from the EC; after 01/01/2021, into Nothern Ireland only) In-Out Box 2 and Box 4 |

- Reclaim | £ |

| (Box 5): | Net VAT to be paid to HM Revenue & Customs or reclaimed by you (Difference between boxes 3 and 4) | = Pay this |

£ |

| (Box 6): | Total value of sales and all other outputs excluding any VAT. Include your box 8 figure | Statistical | £ |

| (Box 7): | Total value of purchases and all other inputs excluding any VAT. Include your box 9 figure Include imports, excluding VAT, relating to postponed VAT accounting shown in Box 4. |

Statistical | £ |

| (Box 8): | Northern Ireland only: Total value of all supplies of goods and related costs, excluding any VAT, to other EC Member States | Statistical and VAT101 form |

£ |

| (Box 9): | Northern Ireland only:Total value of all acquisitions of goods and related costs, excluding any VAT from other EC Member States | Statistical | £ |

| Northern Ireland only: VAT101 to report the value of goods and services supplied to VAT-registered businesses in EU member states, by customer with their EU VAT number. |

Changes due to Brexit

- Normal terms

- VAT is payable to HM Revenue & Customs when goods are imported into UK.

- VAT registered traders charge VAT-on-all-applicable-sales, Outputs Tax, in UK and pay this to HM Revenue & Customs after deducting VAT-paid-out, Inputs Tax.

- VAT is not charged on exports.

- Sales to EU countries are now part of general exports.

- EU terms

- VAT is payable to each individual country's government when goods are imported into EU.

- There have been special terms for UK-EU imports and exports which no longer apply.

- The Brexit Treaty TRADE AND COOPERATION AGREEMENT of 31/12/2020 does not contain any details about routine VAT administration.

- There are 57 pages about combatting VAT fraud.

- The UK Government has published extensive guidance on changes from the UK side.

- EU aspects

- VAT is a fundamental part of the European Union EU.

- UK were obliged to adopt VAT as terms of joining in the European Union EU in 1973.

- Operating within parameters set by EU VAT directives.

- Interpreted by Court of Justice of the European Union CJEU

- After Brexit

- Although outside the parameters set by EU VAT directives, UK is unlikely to discontinue VAT because it is a widely adopted tax in the wider international community - about 160 other countries.

- Keeping the VAT system is part of UK Government policy.

- UK may break loose of minimum and maximum VAT rates set by EU.

- UK may may change the compulsory VAT registration threshold.

- The UK compulsory VAT registration threshold of £85,000 is scheduled for review April 2021.

- Interpretation will be with UK’s Courts but it will be normal legal practice for UK judges to take account of the Court of Justice of the European Union CJEU’s, and it’s predecessor’s, decisions which have evolved over 47 years.