Paying Corporation Tax - electronically online

Or call us

☎ 020 8810 4500 ![]()

I look forward to hearing from you

Vic Woodhouse

Ealing

London

W5 2PJ

You need to do Corporation Tax payment nine months and one day after the end of the accounting period using the Corporation Tax reference number. Daily interest is charged after this date. You can include any interest paid is an allowable expense in your accounts but penalties are not allowable. All Corporation Tax penalties and interest are the liability of the company and not of the directors or shareholders personally. If the company needs time to pay see Time to pay tax.

Pay online

Payment of Corporation Tax directly to HMRC offices by cheque was discontinued after 31st March 2011 although there seems to be no big downside if you do. There are currently no penalties but these could be coming.

Paying by Bank Giro and at the Post Office

You can use the preprinted Corporation Tax payslip.

Banking details shown on preprinted Corporation Tax payslips should not be used for direct electronic online payments. See details below.

Preprinted paperwork is mailed to the registered office and your accountant by HM Revenue & Customs.

If your registered office has changed this will not be picked up by HM Revenue & Customs unless you, or your accountant, have notified your Corporation Tax office.

Perpetual reorganization of Corporation Tax offices may mean that changes have not been implemented even if you have told them.

The routine way to notify HMRC is to enter the new registered office on the next CT600 Corporation Tax return.

Also, your paperwork may not be reaching you if the registered office is with a company formation registration agent.

Paying Corporation Tax directly online

17 digit corporation tax payment reference number

17 digit number

You should always quote your seventeen digit Corporation Tax reference number without gaps. This is on the bottom left of your preprinted payment slip.

If you need to reconstruct it this is:

first:

The 10 characters of your Corporation Tax number

- excluding the initial additional three numbers shown in front of your ten figure Corporation Tax reference number. This is your tax office reference number which is shown on most correspondence but not on the version on the bottom left of your preprinted pay slip.

then

always: A001

then:

a further three digits; two numbers followed by one letter

Making seventeen in all

- If you do not have these any combination of two numbers and one letter is valid say 01A or 99Z

- HMRC suggest 01A, 02A, 03A etc. counting from the first period, bearing in mind that Corporation Tax returns up to the first year end are normally two periods.

- It is best to use the 01A, 02A, 03A sequence because HMRC pre allocate these numbers to the accounting periods and, otherwise, may register payments to the wrong accounting period.

If this happens, the collectors may continue to issue notices for an amount that you have already paid.

It can be difficult to get misallocated amounts corrected.

The general online number verification service seems to have been discontinued but you can check the reference if your company has a Government Gateway set up for Corporation Tax.

The HMRC Help Line to verify the 17 digit reference number by telephone has been discontinued.

HMRC's bank account details for Corporation Tax

- the same as for PAYE NIC and CIS

Payments need to be directed to either Cumbernauld or Shipley except for Worldpay see below one of which will be your allocated pay office. Neither of these is your tax office for Corporation Tax purposes.

To establish whether your pay office is either Shipley or Cumbernauld you need to check your paperwork. If this is not possible HMRC seem to prefer payments to be made to Cumbernauld.

If you are able to contact your Corporation Tax office they should be able to tell you but low service capacity can make telephone contact extremely difficult. The Cumbernauld or Shipley problem is also applicable to Self assessment and PAYE/CIS.

Your responsibility, as a company director, is to pay Corporation Tax and file the form CT600 Company Tax Return. There is no penalty for paying the wrong office and you can expect your funds to be correctly allocated if you provide the right reference number. There are a number of other penalties and interest is charged on late payment of Corporation Tax.

Cumbernauld Accounts Office references

Sort code: 08 32 10

Account number: 12001039

Account name: HMRC Cumbernauld

Payments from abroad quote:

International Bank Account Number (IBAN) GB74CITI08321012001039

SWIFT Bank Identifier Code (BIC): CITIGB2L

Shipley Accounts Office references

Sort code: 08 32 10

Account number: 12001020

Account name: HMRC Shipley

Payments from abroad quote:

International Bank Account Number (IBAN) GB05CITI08321012001020

SWIFT Bank Identifier Code (BIC): CITIGB2L

Paying Corporation Tax by internet, telephone banking or Bacs Direct Credit

Normally takes three bank working days for payment to reach HMRC

Worldpay:

Paying Corporation Tax by debit card or Corporate credit card over the internet

(American Express Amex or Diners Club are not accepted)

Personal credit cards have not been accepted since 13th January 2018.

The payment accounts office Cumbernauld or Shipley is not specified using this method

Debit cards no charge

Corporate credit cards are accepted subject to non refundable fee according to the card used. Non refundable means that if the tax should be refunded, for some reason, the credit card charge will not be repaid.

Worldpay it is counted as paid the same day; although the bank processing time could be three to five days.

There is no telephone service for card payments.

You need your 17 digit reference number from your Corporation Tax payslip or we can establish this for you; see above.

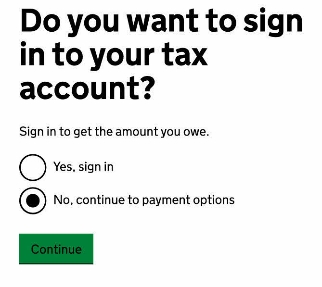

To go into HMRC Worldpay: https://www.tax.service.gov.uk/pay-online/corporation-tax

Paying Corporation Tax by CHAPS transfer

Same day provided you initiate payment within the time specified by your bank, usually between 9.00 am and 3.00 pm.

Time to pay:

HMRC Business Payment Support Service Help Line 0300 200 3835

Payment plan

There is a formal initiative and time to pay helpline for businesses who anticipate needing time to pay. By entering into a time to pay agreement in advance of the due date for VAT and income tax, and adhering to the terms of the agreement, you can avoid VAT late payments penalties and income tax late payment penalties .

You then need to contest and appeal any notices you should subsequently receive. Time to Pay arrangement are often not advised to other parts of HMRC. Ignoring subsequent notices can result in bailiff action.

The scheme started November 2008 and by the end of June 2011: 444,400 proposals were agreed (95% of proposals) and 23,300 were refused. It is estimated that 87% of tax agreed under these arrangements had been paid by June 2011; being £6.7 billion.

It was announced in July 2011 that no further statistics will be issued but "There are no plans to close the Business Payment Support Service or change HMRC's Time to Pay policy or approach".

Tax losses

You can carry tax losses back into previous years.

If you are incurring tax losses in the current year these can be taken into account in Business Payment Support arrangements in respect of overdue and unpaid profit taxes.

You need reliable accounting records to demonstrate this to HMRC.

| Corporation tax rates and marginal relief | Tax year 2024/25 | Tax year 2023/24 | Tax year 2022/23 |

|---|---|---|---|

| From 1 April 2015 to 31 March 2023, a single rate of Corporation Tax applied to all companies. | - | - | 19% |

| At the Spring Budget 2021, the government announced that the Corporation Tax main rate for non-ring fence profits would increase to 25% for profits above £250,000. | |||

| Profits up to £50,000 all Corporation Tax is 19% | 19% | 19% | - |

| Profits over £250,000 all Corporation Tax is 25% | 25% | 25% | - |

| Marginal relief for profits between £50,000 and £250,000 is the Upper limit £250,000 Less the Total amount of Profit subject to Corporation Tax x 1.5% |

|||

| For profits between £50,000 and £250,000, calculate at 25% and then deduct the marginal relief. | |||

- Time allocation for shorter periods.

- Receipts of: dividends or distribution of assets.

- Associated companies.

- If we are preparing your finacial statements, we will do this as part of the service.

Let our corporate accountants in Ealing assist you with efficient corporation tax management and compliance.