SA302 Self Assessment - Tax Calculation and Tax Overview

Or call us

☎ 020 8810 4500 ![]()

I look forward to hearing from you

Vic Woodhouse

20A The Mall

Ealing

London

W5 2PJ

Ealing

London

W5 2PJ

SA302 Self Assessment - Tax Calculation for year ended 5th April

- Lenders and mortgage brokers often request a form SA302

- This shows the taxpayers personal tax calculation as shown in the H M Revenue & Customs record and is accepted as verification of the borrower’s income

- Historically form 302's were always requested from H M Revenue & Customs who would send out the forms by post.

- It shows the full income and tax computation

- H M Revenue & Customs now have a particular policy with the issue of form SA302's

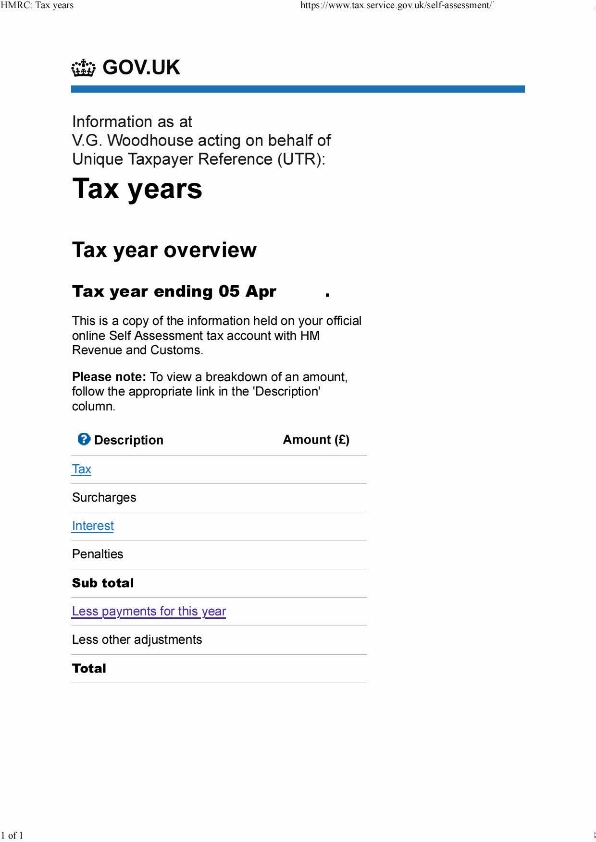

- Tax year Overview TYO (and tax payments for the year)

- A number of lenders have signed up to accepting a Tax Overview.

- Tax overview can be printed from the online HM Revenue & Customs through the Government Gateway by either of:

- The tax payer or

- The taxpayer’s accountant

- Even though Self Assessment tax returns have been filed online, the overview takes some processing time by HMRC before the Tax Overview is available. This should normally be only two or three days.

- The Tax Overview shows just the tax liability;

- and, if any: Surcharges, Interest, Penalties, Payments made, Balance outstanding.

Tax year Overview TYO

Read more

About how to print Tax Overviews

- The Tax Overview is then matched with the tax computation, which has been used to arrive at the tax liability figure, i.e. it shows the taxpayer's income and tax computation, for sending to the lender.

- So this confirms that the tax computation provided by the taxpayer or the accountant agrees with the figure on the HMRC online account.

- H M Revenue & Customs will only provide the traditional form SA302:

- if the request includes the name of the lender

- and the lender is not on the list of lenders who accept Tax Overviews.

- It is often the case, with mortgage brokers, that the lender is not known at the outset and the Tax Overview and accountants tax computation is the only documentation which can be provided.

- If you know the name of the lender, please check the list of lenders who will accept a Tax Overview and let us know; we will organise the appropriate paperwork.

- Apply for a Government Gateway

- You first enter your email address.

- You get back a confirmation code which you use to move forward with the application.

- Have available:

- Unique Taxpayer Reference UTR - if you have one.

- National Insurance number.

- Driving license or passport details to link you into other Government records.

- There are various security checking options; you have to choose two. The driving license and passport options are the most straight-forward.

- Telephone number.

- You need to be ready to receive text or email security numbers from HMRC.

- Apply: "Create sign in details" on the Sign in screen.

- You get a Government Gateway number.

- Set the Password.

- You are then ready to use the Government Gateway

Read more

list of lenders who accept Tax Overviews

What lenders want to assess:

- Whether you can afford the interest.

- Whether you can afford the repayments.

- Available security.

- Normal outgoings including tax liabilities.

- Tax liabilities and tax paid are shown on the Tax Year Overview.

- The lender may want to see, on the Tax Year Overview, that tax is actually paid.

- They may want to see tax paid in advance of the normal due date for payment.

If you work for your own company

- If you work for your own company you need to approach lenders who are prepared to consider the whole business situation.

- These could be your bank or possibly other banks.

- Certain building societies.

Many of the big-name lenders work on the basis of PAYE pay slips